Introduction to Macroeconomics

Week 02

ModernMacro team

Instituto Universitário de Lisboa (ISCTE-IUL)

February 9, 2026

1. The Practice of Macroeconomics

Macroeconomics versus Microeconomics

. . .

Microeconomics:

- Studies the optimal decision making process of a household, a firm, one market.

- Usually, this process is considered free from any political interference (trade-unions, business confederations, lobbying processes)

. . .

Macroeconomics :

- Studies the working of an economy as a whole (all households, all firms, all markets)

- Usually, the economic policies designed by public decision making institutions (Government, Central Bank) to manage the performance of the economy are not free from political influence and lobbying processes

Macroeconomics vs Microeconomics: Examples

- The interest rate that Maria pays for her mortgage is a “micro” variable

- The interest rate that the European Central Bank (ECB) sets for the entire EuroZone (EZ) is a “macro” variable

- The increase in the price of electricity is a “micro” variable

- The rate of inflation (of all goods and services) is a “macro” variable

- Can you come up with another example?

Why Macroeconomic “Models”?

. . .

- Complexity. The structure of an entire economy is extremely complex:

- millions of consumers, firms by the hundreds of thousands

- huge number of goods and services, and prices as well

- huge number of monetary and financial instruments

. . .

- Experiments are impossible. It is simply impossible to “see” what is happening in the tremendous complexity beneath a modern economy.

. . .

- Simplify. We need to simplify that huge complexity: that is the task of building an (abstract) economic model

- Model: a simplification … not a falsification of economic reality

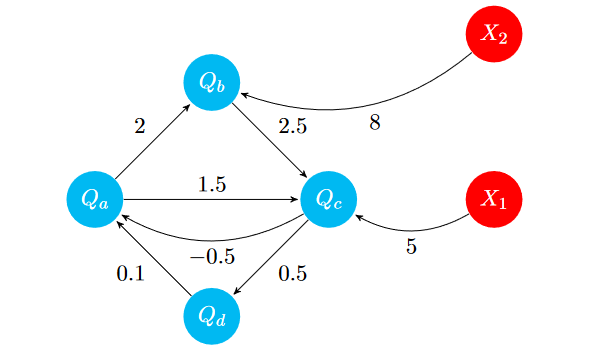

A Graphical Example of a Model

\(~~~~~~~~~~~~\)

- Inputs: \(\{X_1, X_2 \}\)

- Structure: \(\{2,0.1,-0.5,8,1.5,...\}\)

- Outputs: \(\{Q_a,Q_b,Q_c,Q_d \}\)

The Elements of a Macroeconomic Model

- Inputs: the values of the exogenous variables

- Structure: set of impacts given by the parameters values

- Outputs: values of the endogenous variables

- Agents:

- Private agents: consumers, firms, commercial banks, financial firms, foreign agents

- Public agents: government, central bank (they have the power granted by law to implement policy measures)

- Markets: Goods & Services (G&S), labour, money, foreign currencies

2. The Purpose of Macroeconomics

Main Macroeconomic Variables

- Real GDP (Gross Domestic Product)

- Unemployment Rate

- Inflation rate

- Interest rate

Excellent sources of macroeconomic data:

- For the US economy go here: FRED Economic Data

- For the EU economy go here: EUROSTAT Data

- For World economic data: TED Data

Real GDP

Next week, we will define with rigor what “Real GDP” is all about. The next figure shows the evolution of Real GDP for the US economy.

. . .

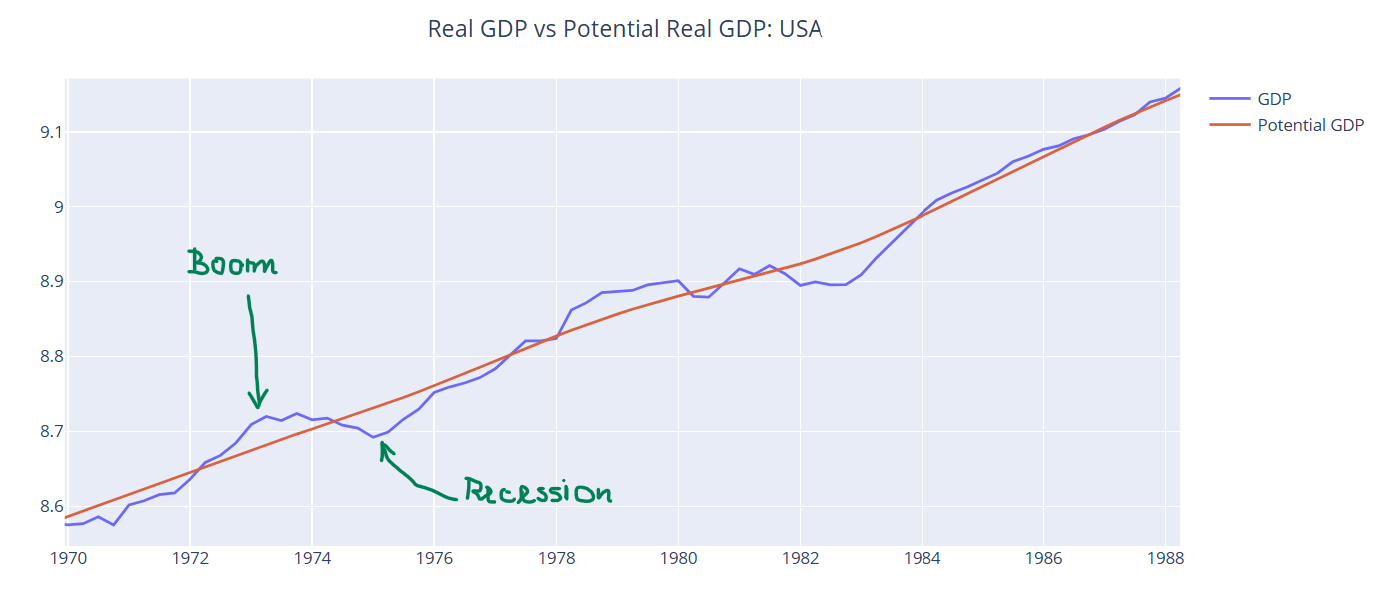

Real GDP vs Potential GDP

The previous figure does not provide much information by itself. Why?

- In which periods GDP grew at higher rates?

- In what periods the US economy was performing above/below its potential GDP level?

- This raises to the surface another crucial aggregate: Potential Real GDP.

- Business cycles consist of short-term variations in macroeconomic activity and comprise booms & recessions.

- An economic recession: Real GDP is much smaller than Potential Real GDP.

- An economic boom: ???

Real GDP vs Potential GDP: USA (1955-2024)

. . .

Data source: FRED Economic Data

Real GDP vs Potential Real GDP: USA

. . .

A closer view: we can zoom in between 1970 and 1988

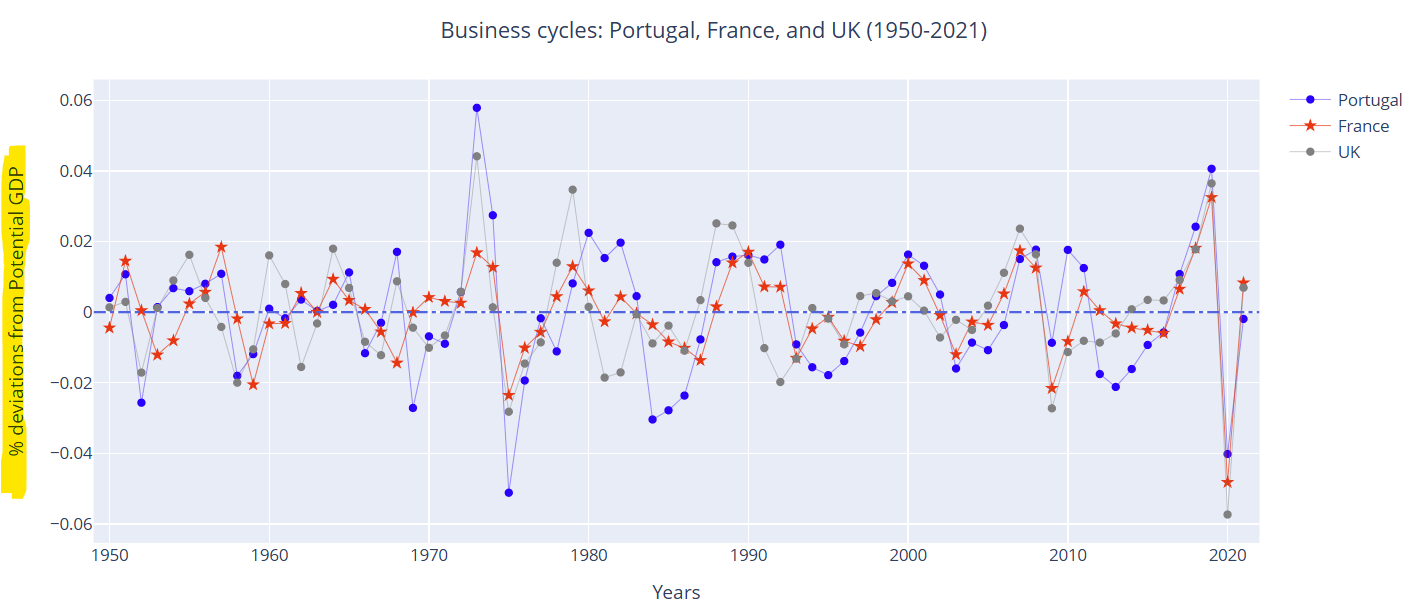

Business cycles

. . .

Percentage deviations of real GDP from Potential GDP

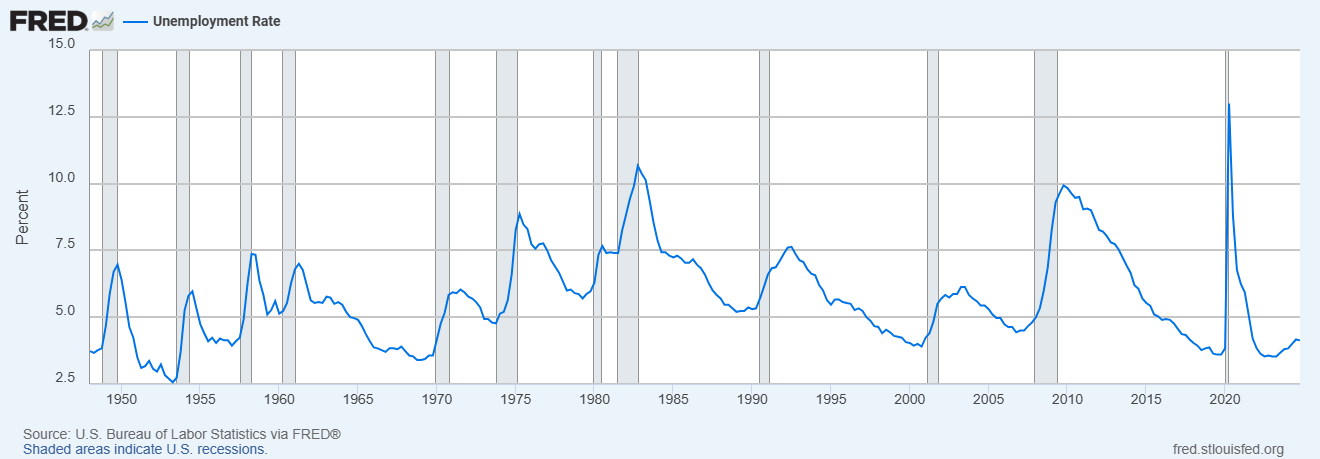

The Unemployment Rate: USA 1947-2024

. . .

The % of the labor force that does not have a job

Data source: FRED Economic Data

Inflation in the Euro Zone (EZ): 1997-2025

. . .

The inflation rate is, normally, taken as the percentage change in the CPI (Consumer Price Index). Central banks have a target level: 2% per year.

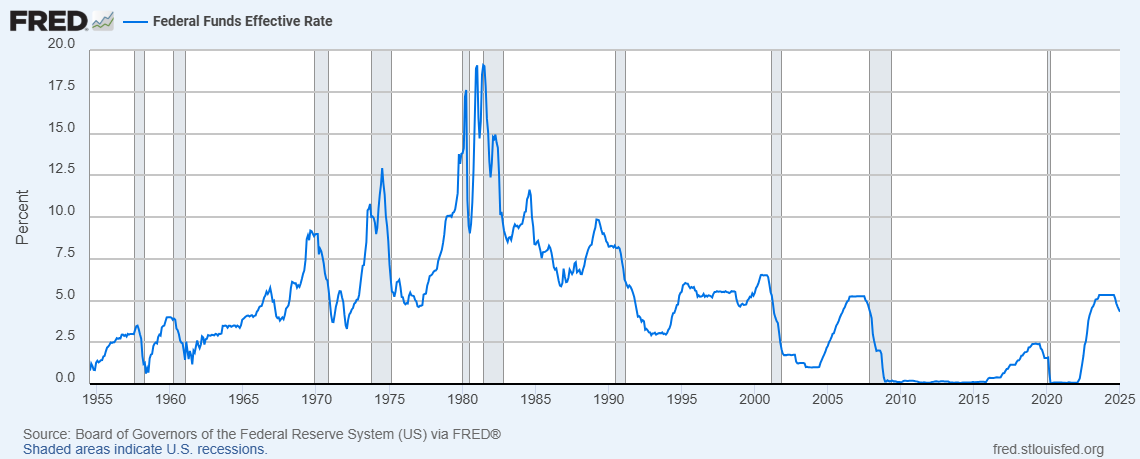

The Interest Rate in the USA (FFR)

. . .

The Federal Funds Rate (FFR) is the most important short-term interest rate in the US. In week 6 we will learn more about it.

Data source: FRED Economic Data

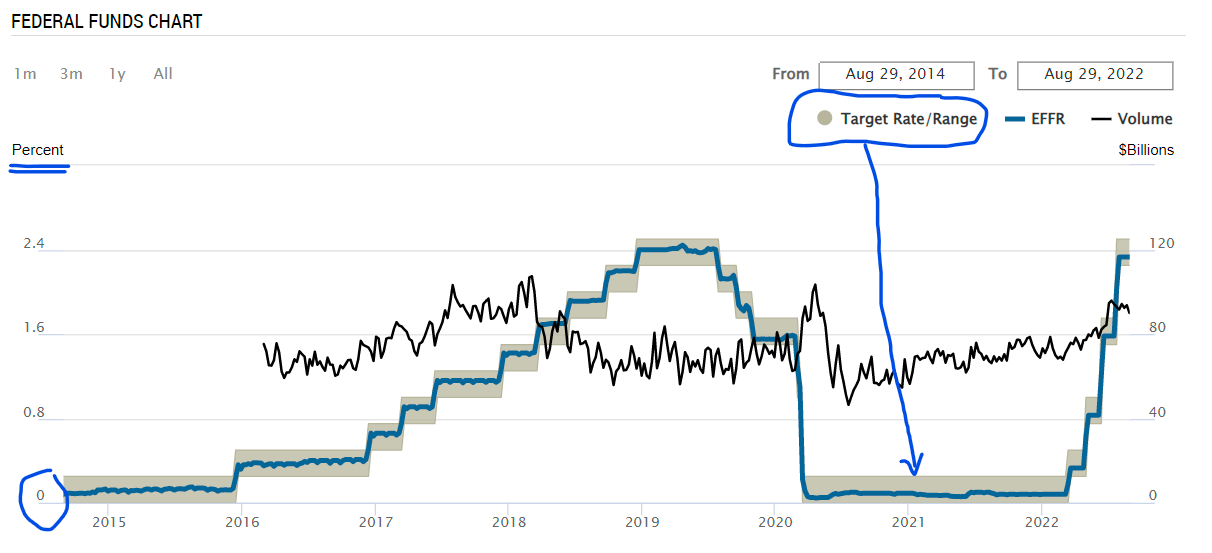

Target Interest Rate in the USA

. . .

The central bank of the USA (Federal Reserve Board, or simply Fed) sets the range of the target rate for trading in the federal funds market.

\(~~~~~~~~\)

Source: FRB of New York

3. Macroeconomic Policy

What is Macroeconomic Policy?

- It is the intervention of public institutions (the Government and the Central bank) in the functioning of the economy.

- Is it necessary?

What is Macroeconomic Policy?

Yes, for several reasons:

Exogenous shocks. The economy may be hit by shocks that have dramatic impacts on the entire economy (like Covid, war in Ukraine, a large increase in oil prices, etc.)

Market failures. Some sectors have to be regulated because they are prone to market failures (like natural monopolies, collusion, externalities)

Dishonest behavior. Some private agents may behave dishonestly (moral hazard) and may lead to a dramatic collapse of an entire sector in the economy (like bankruptcies)

High volatility. The economy is very volatile … even in the short term

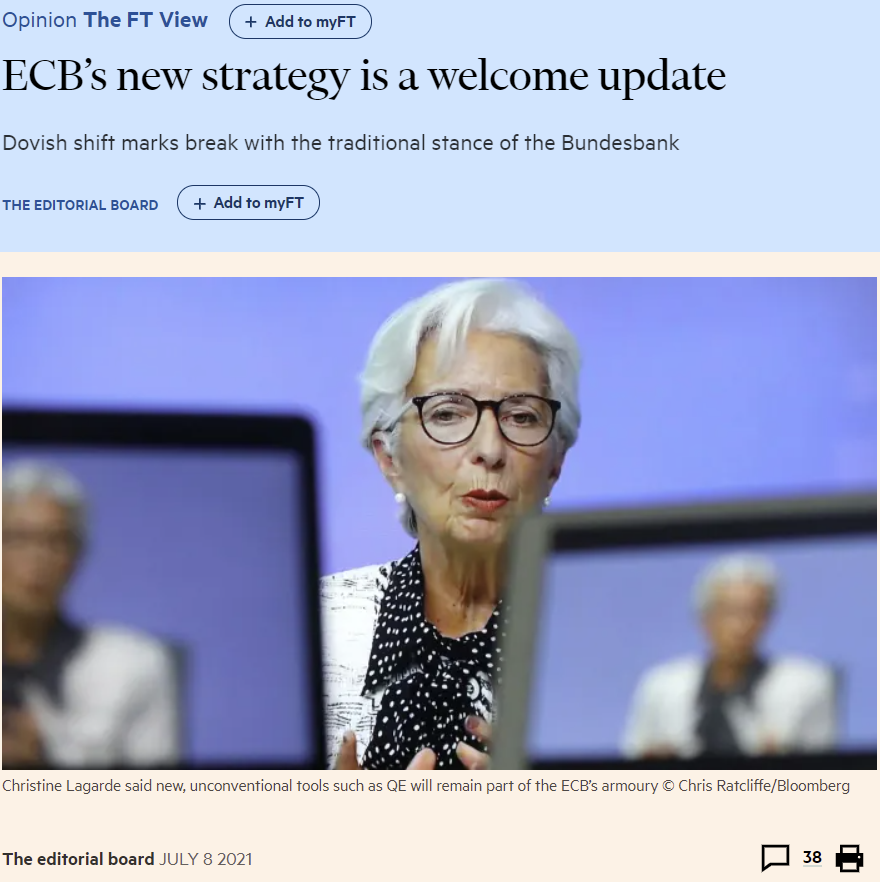

The Summer 2021’s Big Problem: DEFLATION

- Everybody was concerned about deflation (negative inflation rates)

- One FT’s editorial applauded the move by the ECB to review its policy strategy in July 2021

- Keep interest rates at 0% or even negative if necessary

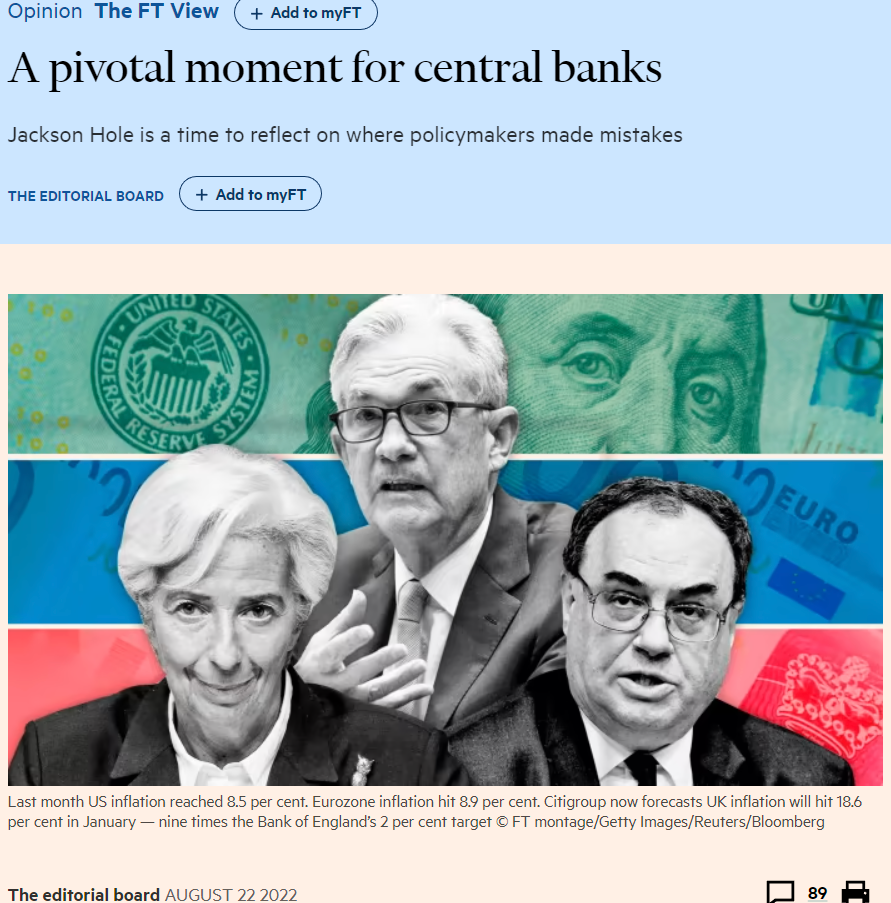

Summer 2022’s Big Problem: PACY INFLATION

- Suddenly, in 12 months, inflation increased around 6 or 7 percentage points in most Western economies

- Central banks were forced to increase interest rates very aggressively

- Another FT’s editorial applauded the courage of central banks in July 2022

Financial Crisis and Spread Volatility

. . .

Financial crisis lead to large jumps in spreads in the financial markets. Data source: FRED Economic Data

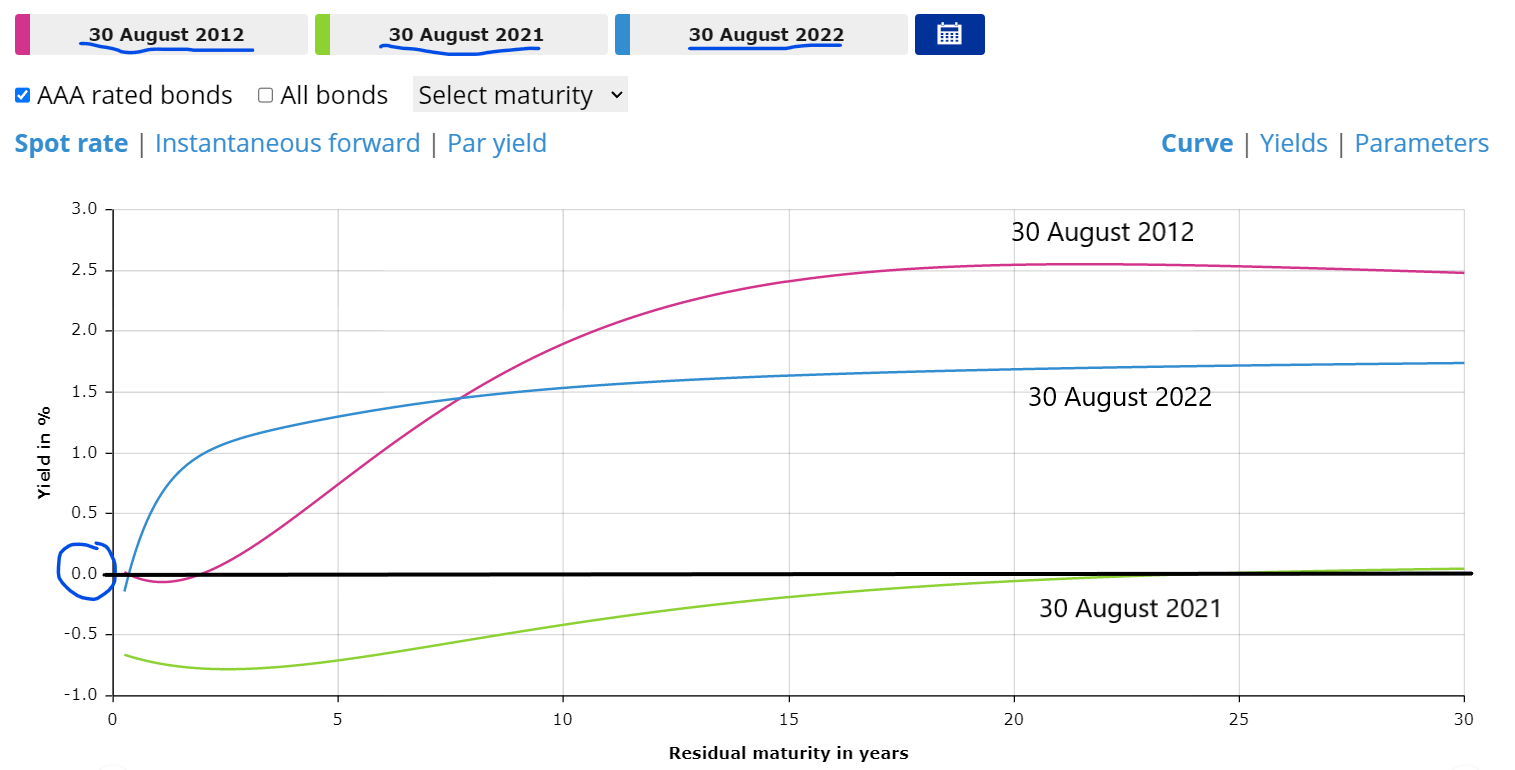

Macroeconomic Instability and Yields

. . .

Macroeconomic instability leads to large and abrupt changes in the yields of financial assets. \(~~~~~~~~~~~\)

Data source: European Central Bank

How Active Should Stabilization Policy Be?

Economic activity is highly volatile and the Government and the Central Bank should intervene to stabilize economic activity … when needed

How often and with what intensity should those institutions intervene?

____________________________________________________________________Activists (also known as Keynesians):

- They favor regular and extensive use of such interventions

- Booms and recessions are bad for social and economic reasons

Non-activists (also known as Classicals):

- They are against those interventions

- Booms and recessions are the “natural” reactions of markets to shocks that hit the economy

Should Macroeconomic Policy Follow Rules?

- The two fundamental macroeconomic polices are:

- Fiscal policy (Government)

- Monetary Policy (Central bank)

- Should those policy-making institutions conduct their policies according to:

- Discretion: no rules previously announced; decide as you consider best, given the circumstances

- Commitment to rules: announce rules and show commitment to such rules no matter the circumstances that my come.

- Rules are good but sometimes they may put policymakers in a straitjacket.

4. Readings

Readings

Read Chapter 1 of the adopted textbook:

Frederic S. Mishkin (2015). Macroeconomics: Policy & Practice, 2nd Edition, Person.